The NeverLossTrading Principle

Experience how and why our way of approaching and trading the financial markets can make a difference for you.

Base

The financial market action is complex and CANNOT be described by mathematical functions; however, it can be detected by mathematical functions:

There are multiple layers of financial actions and transactions and we like to invite you, looking at Level-II and Level-III information, to spot if there is a change in supply or demand, which reflects itself in a price change.

Instead of relating past data, we are looking at the action of now and portrait certain changes in price/time-unit, volatility/time-unit and volume/time-unit to catch, similar to seismic waves:

- A pre-stage of a potential directional price move

- The initiation stage of a potential directional price move

- A continuation stage of a potential price move

- The exhaustion stage of a potential price move

The NeverLossTrading Model: Detecting and Projecting Directional Price Action

What we do has nothing to do with common assumptions mathematical models for price predictions implicate:

- Reversal to the mean: Why should the price follow this rule?

- Moving average breakouts: What does today’s asset price has to do with what happened 50 days ago?

- Wave principle: Why should the 1-2-3-wave be continued by the ABC-wave?

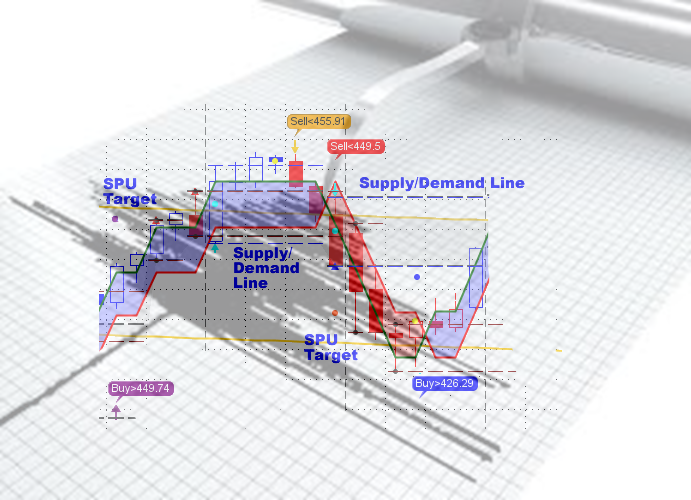

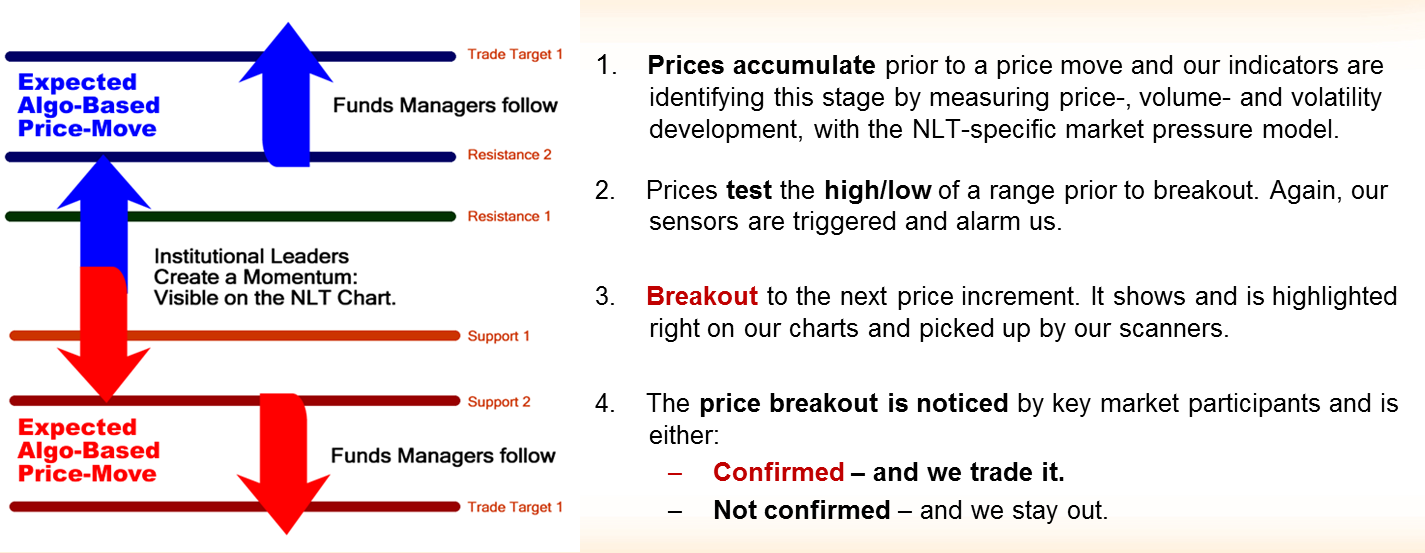

When our seismic financial market measure indicates potential price move, we only put money behind the action if other market participants confirm the new trade direction for us according to the following price move model:

In addition, we understand that key asset holders will have a strong need to re-balance their inventories and thus, at a certain price expansion point will either float- or shorten supply, which will result in an opposite directional price move; taking away from our profits. Knowing this, we pre-calculate how far the expected price move shall reach and we take profit, before we assume it will retrace or revers.

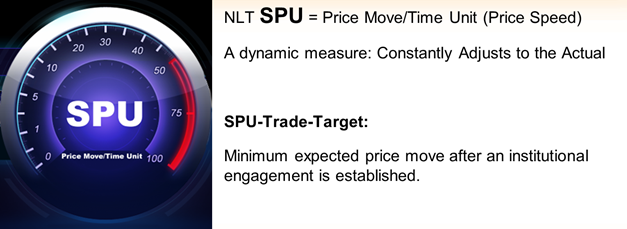

Our tool to calculate the expected price move is the SPU = Speed Unit

Who Produces Changes on Level-II and Level-III?

You are already seeing in our SPU definition that we relate to institutional price moves.

Why are institutional investments so important to what we do as private investors?

Institutions dominate more than 85% of all financial markets: Stocks, commodities, currencies, treasuries.

Let us take an excursion into the world of the financial markets, where all participants focus on bettering their positions at the cost of other participants; following the Pareto Efficiency Principle:

Pareto is mostly known for the 80/20 principle, but he also taught us:

Vilfredo Pareto: 1848 - 1923 Italian Economist and Mathematician |

Pareto Efficiency Principle |

|

In an efficient economic situation (Financial Markets), Individuals are maximizing their utility. The final allocation decision cannot be improved upon, given a limited amount of resources, without causing harm to one of the participants.

Activity-Based Trading translates this principle into algorithms that let you spot and follow institutional actions. |

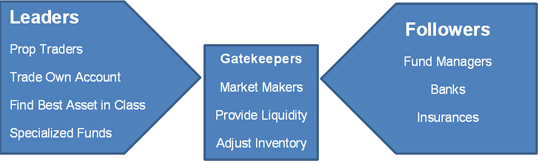

Who are the actors or inter-actors of the financial markets?

We differentiate as follows:

Categories of Institutional Investors

We use the term inter-actors to portrait that key market influencers: institutions, are not only playing in one field, they rather cover all categories:

Prop-Traders act as Market Makers (liquidity providers), and offer Funds.

Let us characterize their focus and whom we are talking about:

Examples for Institutional Investors

Is it really that simple, that only a defined number of institutional investors control the financial world?

Let us reference a study by the EHT Zurich, which took the 40,000 biggest trans-national corporations reported under the OECD (Organization for Economic Co-operation and Development, with 34 participating countries, founded in 1961 to stimulate economic progress and world trade). They were mapping the ownership relations of those trans-national corporations. See the outcome:

Graph-5: Ownership Relations of Trans-National Corporations

Let us list the top 25 companies from the list of 147 for you:

Graph-6: The Network of Global Corporate Control

BARCLAYS PLC (GB) CAPITAL GROUP COMPANIES (US) FMR CORP (US) AXA (F) STATE STREET CORPORATION (US) JPMORGAN CHASE & CO. (US) LEGAL & GENERAL GROUP PLC (GB) VANGUARD GROUP, INC., THE (US) UBS AG (CH)

|

MERRILL LYNCH & CO., INC.(US) WELLINGTON MANAGEMENT CO. L.L.P. (US) DEUTSCHE BANK AG (D) FRANKLIN RESOURCES (US) CREDIT SUISSE GROUP (CH) WALTON ENTERPRISES LLC(US) BANK OF NEW YORK MELLON CORP (US) GOLDMAN SACHS GROUP, INC (US) |

NATIXIS (F) T. ROWE PRICE GROUP, INC. (US) LEGG MASON, INC. (US) MORGAN STANLEY (US) MITSUBISHI UFJ FINANCIAL GROUP, INC. (JPN) NORTHERN TRUST CORPORATION SOCIÉTÉ GÉNÉRALE (F) BANK OF AMERICA CORPORATION (US) |

With source data related back to 2007, what happened in the meantime: Did the markets diversify or concentrate?

To answer this question, let us look at the development of investment vehicles: Prior to the financial crisis, private investors heavily relied on mutual funds; however, since the financial crisis, mutual fund investment stagnated and is mostly tied to 401(k) plans where no other investment options are offered. On the other hand, specialized funds, offered from institutions, exclusively to institutions, increased by 50% and attracted a $300 billion of additional investment volume.

Why this?

Insurances and banks recognized that prop-traders offered funds had a higher success rate than their own investments and thus, moved work, responsibility, and money:

Fund Management since the Financial Crisis

What does this mean for your trading?

Investment leaders have an even stronger position and their actions leave a trace in the market by producing changes in supply or demand. With the right instruments on hand, you can spot and follow trade setups that have a high probability of leading to directional price moves, regardless of the base for the institutional trading- or investing decision: fundamental or technical.

To help you with finding those constellations, we developed and share activity-based trading systems; portraying high probability, repetitive chart constellations for all asset classes on your charts: for stocks, their options, commodities, currencies, and treasuries. When you trade on meaningful reward to risk relations, you are up for producing income from your trading- or investing activities.

How to Trade Activity-Based

Please see a short list of critical questions you need to be capable of answering prior to entering the financial markets on your own:

What to Trade?

|

When to Trade? |

How to Trade? |

Trade Preparation |

Control System |

Asset Know-How Market Knowledge

|

Situation Analysis Trade Selection Entry, Exit, Stop

|

Market Access Time, Range, Tick

|

Critical Times Lot Size Mental Preparation |

Journal/Statistics Risk Management

|

NeverLossTrading Plan for Day Trading, Swing Trading, Long-Term Investment |

||||

We are here for helping you to answer those questions at ease, focusing on one-on-one training with the best fitting trading system that suits your style, your risk tolerance, and personal trading situation.

NLT Top-Line Chart for NFLX (trade setups when the spelled buy/sell signal threshold is surpassed in the next candle)

The 4-Hour NFLX chart shows a SPU measure at the current bar of $3.5, which indicates a potential return on cash of $3.3%.

You see three buy signals that were confirmed by the next candle surpassing the set price threshold and we closed the trade either when a 2-SPU price move was concluded or at the 5th candle, including the trade-initiation-candle.

- Buy> 92.59 was exited at a 2-SPU price move of $3.40 (3.7%-return in one day).

- Buy>95.26 was exited at the 2-SPU goal with profit $4.40 (4.6% in two days).

- Sell<93.57 was exited at candle #5 with a small profit of $0.80 (0.9% in two days).

- Buy>95.19 was exited at the 2-SPU goal with profit of $3.13 (3.3% in two days).

In the above chart, in three out of four trade situations, the rule-based trader was better on, taking a positive exit at a pre-defined candle-sequence or at a 2-SPU price move: so, in 75% of the cases you were better on, holding yourself accountable for following clearly defined rules: make them part of your trading.

It is an imperative for successful trading to appraise every trade situation, to only trade when the odds are in your favor: We give you those tools on hand to appraise right from the chart or by the help of our calculation tables. We appraise the Odds Ratio by calculating:

(probability of winning x reward) / (probability of losing x risk).

To trade with the odds in your favor, this ratio shall be >1.5, else do not accept a trade.

The odds appraisal depends on the strength of your trading system. Commonly, moving average-based systems (MACD, Bollinger Band, Stochastic…) have an attainment rate of about 55%; high probability trading starts at a 65% attainment rate and very strong systems produce above 75% winners; however, the winning percentage alone does not guarantee trading success. For bringing a directional trade to target, while the price moves in your desired direction, you need to give your trades an adequate wiggle room, which defines the relation of risk to reward in a trade.

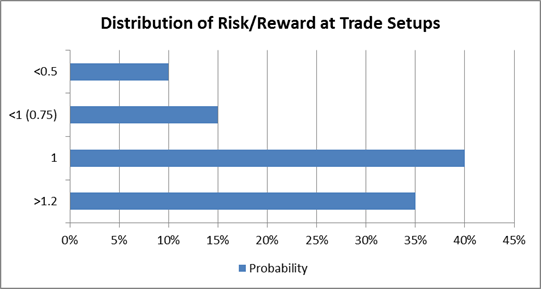

Based on our statistics, we experienced the following risk/reward-distribution at trade-setups to bring the trade to target:

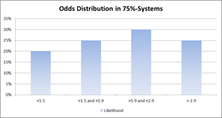

Likelihood of Reward/Risk-Constellations at Trade Setup

By the above graphic, you will have a 10% probability to spot reward/risk setups that have 2-times the reward to risk or $0.5 risk on an expected $1 reward; however, in 35% of the cases, you need to give the price a >1.2-times-reward-wiggle-room to come to target; 40% of the time, you find a 1:1 reward/risk relationship, giving you only in 25% of the cases situations where the reward is higher than your risk.

Key question: How do you find such setups?

Surely, you can go through hundreds of charts; however, you can also use an alert service, which is helping you to find the specific chart setups you are looking for:

Check out NLT Alerts and click here for a special offer…click.

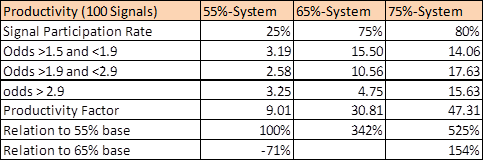

In the next step, we pair the reward/risk-distribution with the odds calculation for a 55%-, 65%-, and 75% attainment-rate/probability trading system.

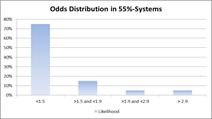

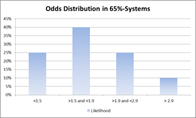

Approximated Odds Distribution by System Probability (click to maginify)

The comparison graphic shows: When using a system with a 55% probability to spot the right direction, in 75% of the trade setups you find, the odds are not in your favor: Odds-Ratio < 1.5.

This relation drastically changes, when you are using a 65%-probability system, where 75% of the trade setups you might find will produce acceptable and sound trade returns.

When you are able to trade at a 75% attainment rate, you can really stacker the odds in your favor by finding 55% trade setups with odds ratios above 2.

We hope you see the value of what is shared here: In case you remain with a low probability system (back test it over 100-trades based on clearly set rules), please be aware how you drastically reduce your productivity rate: returns produced over time.

When we assume the same amount of signals per observed time-unit, and calculate for the three systems the productivity rate by relating the participation rate with the odds ratio and probability for success, we come to the following results:

Trading Systems Compared by a Productivity Measure

These calculations show: When you are using a higher probability trading system, your productivity rate is three 3.4-times (340%) higher when moving from a 55%-system to a 65%-system and 5.25-times higher when moving to a 75%-system. A 75%-system produces a 54% higher return than a 65%-system.

How to Learn trading NeverLossTrading Style

Unfortunately, we are used to going to a school, “graduating” classroom style.

When teaching classroom style, the efforts of the teacher are directed to assimilating the differences in interest, way of learning, and capability, to securing a uniform rate of progress among all the members of the class:

- Why to learn how to trade Apple, when you want to focus on trading Crude Oil.

- The slowest in your class determines your pace of learning.

- You might end up being the number 20 in line for getting your question answered.

If you want to progress as a trader: Classroom style learning is inefficient.

You want to get coached one-on-one: Apply what you learned, make mistakes and try again, until the learned goes into your long-term memory, so you can apply it.

At NeverLossTrading:

- You receive one-on-one teaching, focused on your wants and needs.

- Each session is recorded so you can repeat multiple times what you learned.

- You receive electronic documentation with detailed trade setups examples.

- We work with you to build a business plan for your trading: Strategy, financial plan and action plan.

- You will receive free NLT Alerts, highlighting assets that carry the chart setup you learned to operate with.

- You are up for constant feedback how you applied what you learned during the mentorship period.

The easiest way to play in the league of professional traders is to act like they do:

- Spot and follow institutional money moves right from your computer screen at any place in the world (all software setups will be installed for you).

- Learn in individual sessions how to trade the financial markets like a pro:

- What and when to trade.

- Trading/investing strategies, incl. hedging and leveraging.

- Trade mechanics: order execution.

- Odds evaluation and position sizing.

- Risk management.

- Continues Improvement

- Have an edge by being capable to open and close entire positions faster and more frequent than institutions can do this.

- Receive recordings and documentations to easily repeat and re-learn all actions.

- Receive Alerts of assets with favorable indicator setups.

NeverLossTrading offers a multiple mentorship programs for day traders, swing traders and long-term investors. Find the program that suits you best (click the highlighted mentorship):

Focus |

Mentorship |

Specifics |

Trade Initiation |

Day Trading |

|

Frequent Trades

|

|

|

Momentum Swings |

|

|

Swing & Day Trading

Long-Term Investing |

|

|

|

|

|

Initiation and continuation patterns |

|

|

|

|

Supply/Demand Patterns |

|

|

Swing Trading

|

|

Frequent Trades

|

|

|

Momentum Swings |

|

TradeColors.com is our introductory program for day trading, swing trading and long-term investing. If you decide to make this your start into the world of activity-based trading, you can always upgrade to a next level program, getting the tuition you already paid acknowledged.

Click here for a PDF format of our offering.

Arrange your personal consulting hours:

Call +1 866 455 4520 or contact@NeverLossTrading.com

We are looking forward to hearing back from you,

For questions, please do not hesitate to contact us. contact@NeverLossTrading.com

If you are not yet part of our free reports, trading tips, and Webinars...sign up here.

Download your PDF copy...click.

Good trading,

Contact us

|

Sign our VIP introduction: Click here.... |

|---|---|

|

Annual Subscription!

Participate in our webinars were we will discuss the different trading strategies for the upcoming week. |

|

Learn to be a Successful Financial Market Investor!

Treat trading as a business: Prepare your mind, set you own goals, execute NeverLossTrading® , attain set returns, reach your financial goals. |

Disclaimer

The risk of trading securities, options, futures can be substantial. Customers must consider all relevant risk factors, including their own personal financial situation before trading. In our teaching of how to trade the markets, in our newsletters, webinars and our involvement in the Investment Clubs, neither NOBEL Living, LLC, the parent company of NeverLossTrading® , or any of the speakers, staff or members act as stockbrokers, broker dealers, or registered investment advisers. We worked out trading concepts and share them through education with our members and clients.

US Stock Market Holiday Schedule:

US Stock Market Holiday Schedule: